|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Cash Out Refinance Lenders in Texas: Key Insights for HomeownersCash out refinancing is an attractive option for many homeowners in Texas looking to leverage their home equity. By understanding the key aspects of cash out refinance lenders, you can make informed decisions about refinancing your home. What is Cash Out Refinancing?Cash out refinancing allows homeowners to replace their existing mortgage with a new one that has a higher balance, converting home equity into cash. This option can be beneficial for funding major expenses or consolidating debt. Benefits of Cash Out Refinancing

Choosing the Right LenderSelecting a lender is a crucial step in the refinancing process. It's important to compare offers from multiple reputable home refinance companies to find the best terms. Factors to Consider

For more insights on whether this option suits you, visit should i refinance fha loan for guidance. Eligibility and RequirementsUnderstanding the eligibility criteria is essential for a successful refinance application. Common Requirements

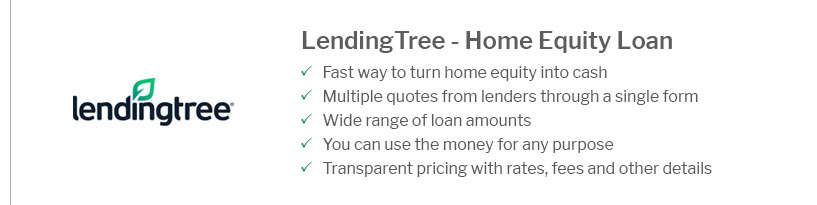

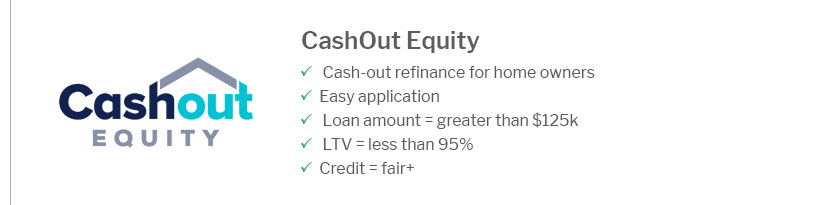

FAQ SectionWhat is the difference between cash out refinance and home equity loan?While both options allow you to borrow against home equity, a cash out refinance replaces your existing mortgage, whereas a home equity loan is a separate loan with its own terms. How much cash can I get with a cash out refinance?The amount depends on your home equity and the lender's terms, but most lenders allow you to cash out up to 80% of your home's value. Are there risks involved in cash out refinancing?Yes, potential risks include higher monthly payments and increased total interest over the loan term. It's essential to consider these factors carefully. Can I refinance if my credit score is low?While a low credit score can limit options, some lenders specialize in offering loans to those with less-than-perfect credit, though at higher interest rates. In conclusion, cash out refinancing can be a strategic financial move if executed with careful consideration of the terms and conditions offered by various lenders. To explore further options, visit reputable home refinance companies for a comprehensive comparison. https://lonestarfinancing.com/cash-out-refinance/

Texas Cash-Out Refinance: Unlock Your Home's Equity. Lone Star Financing is a direct mortgage lender that specializes in Texas Cash Outs. With in-house ... https://www.texaslending.com/texas-cash-out/

A Texas cash-out refinance loan is also called a Section 50(a)(6) loan. With this option, you refinance your current mortgage while also tapping into your home ... https://trb.bank/mortgage-news/how-does-a-cash-out-refinance-work/

A cash-out refinance lets you borrow against the equity in your home. With a cash-out refinance, you exchange your existing mortgage for a new mortgage.

|

|---|